Commercial Combined insurance

Commercial Combined cover to help you win and retain business

DUAL Commercial Combined gives select brokers access to a service and appetite proposition not readily available from Composites.

Delivered through expert, accessible underwriters, and backed by long term A-rated carriers. Our underwriters are based in regional trading branches throughout the UK and know your industries, so you get informed decisions, fast.

£10k to £50k

Target premium range

Broad appetite

Underwritten by experts

Key benefits

Frequent access to experienced underwriters

Every customer is of equal importance to us. You'll benefit from direct access to local underwriting experts with a speedy response. Our offices are located in London and Northwest, Midlands and the Southwest.

Tailored support for new and renewing clients

We have a broad appetite and can help you if you are prospecting a new client or protecting a renewal. Our modern policy structure allows tailored combinations of cover to suit diverse industries and trading models.

Bespoke cover built for today’s risks

Our modern wording reflects the real exposures businesses face, with 12 sections of cover and options for customisation.

We'll support your risks with 'wrinkles'

We're building specialisms in misunderstood and diverse trades, helping you find solutions where others have said no.

What’s covered

DUAL’s Commercial Combined proposition offers a flexible, modular policy structure to suit SME+ and Mid-Market risks.

Property damage

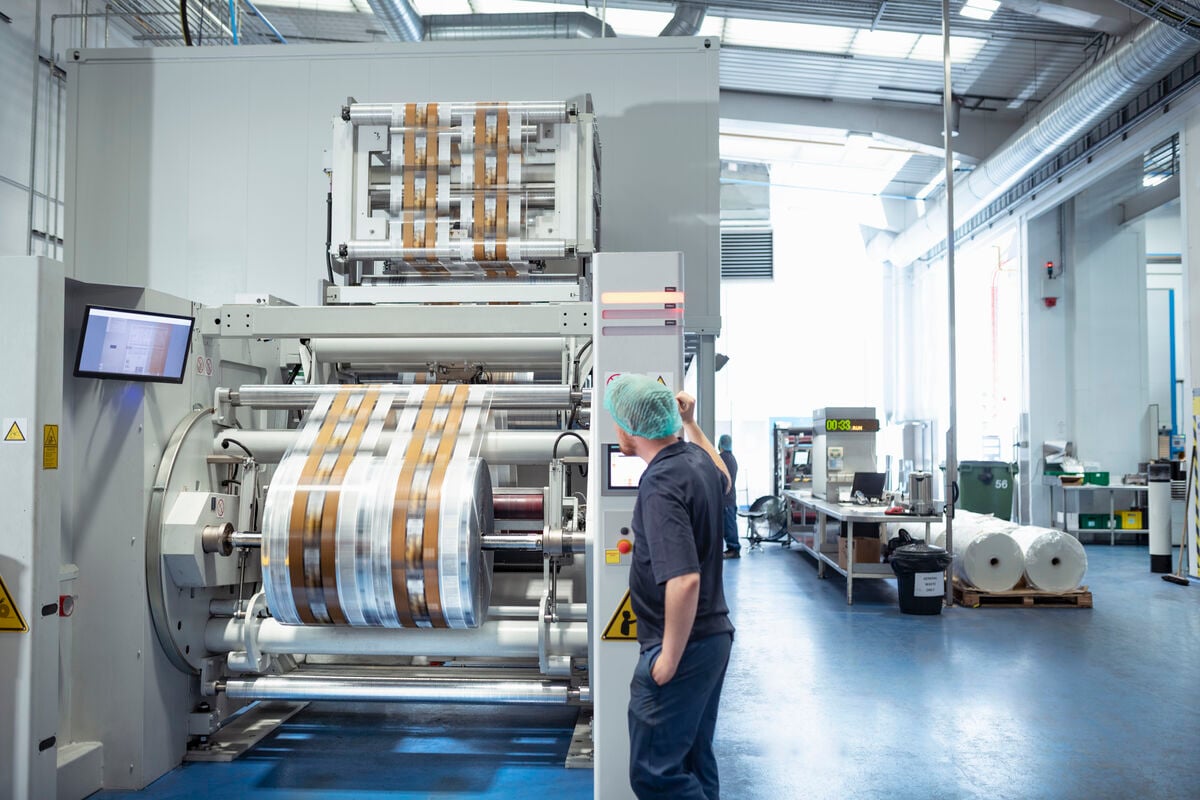

Tailored for risks from manufacturing to joinery. We assess past losses in context, not in isolation.

Business interruption

We provide customised coverage that takes into account your specific needs, ensuring that you're protected whether you're recovering from a loss or facing operational disruptions.

Employers’ liability

Standard cover with a responsive underwriting view on trades involving machinery or specialist labour.

Public and products liability

We can consider certain exports, including to the US, provided contractual protections (e.g. rights of recourse) are in place.

Financial loss (where available)

Enhanced limits available where clients need to meet contract or tender requirements, particularly common in print and supply sectors.

Work away and contracting risks

Where trades involve offsite or client-site activity, we assess role and responsibility to avoid misclassifying structural work.

Product exports

Selective appetite for benign US exposure, subject to assessment of representation, hold harmless clauses and jurisdiction.

If a trade falls outside automated appetite, our underwriters are available to review submissions manually and explore realistic options.

Examples of our appetite

Manufacturing (metalworking, textiles, electronics and telecoms, machinery, plastics, printing)

Artisan food and drink (cheese, distilleries, microbreweries)

Wholesale trade except motor vehicles

Financial and insurance activities

Information and communication

Professional, scientific and technical activities

Administration and support activities

Public administration

We don’t cover

- Education (Primary and Secondary)

- Electricity, Gas, Steam, Air Conditioning Supply

- Forestry and Fishing

- Manufacturing;

- Chemicals

- Foam/Rubber

- Motor Vehicles

- Petroleum Products

- Pharmaceuticals

- Tobacco

- Laundries

- Mining and Quarrying

- Recycling/Waste

- Transportation and Haulage

- Water Supply, Sewerage and Waste

For more complex trades, our in-house risk surveyors and technical underwriters provide case-by-case assessment. Please contact us below for more information.

Download our appetite sheet

Underwriting requirements

We aim to minimise friction. To quote, we typically need the:

- Fully completed presentation or proposal

- Details of any past claims or large losses

- Risk improvement evidence (where relevant)

- Clarification on work away, process risk or exports

- Contract / tender requirements for bespoke limits

For urgent or renewal-driven placements, we can work from broker summaries, with formal documents to follow.

Our partner of choice for claims handling

Making a ClaimIn the event of a Claim please contact DUAL and send the claims form to: |

2024

Claims team of the Year at the British Claims Awards

42,000

Short and long tail notifications in 2023

Why choose DUAL

Built for Commercial Combined, not bolted on

We don’t treat Commercial Combined as a second thought. It’s a core focus, and we’ve built the team and appetite to prove it.

Underwriters who know your market

Commercial risks need commercial thinking. You’ll speak directly to the underwriters who make the decisions. This means you get fast, consistent answers from people who understand what you’re placing.

We’re committed to UK brokers

Every client matters. Every broker matters. We aim to make working with us simple, direct and worthwhile. Our underwriters are aligned to specific brokerages to build meaningful partnerships.

To get in touch

Please speak to one of our local DUAL teams below or use the contact form at the bottom of the page.

North West

Midlands and South West

London